/1/8 · Gapping is when a stock, or another trading instrument, opens above or below the previous day’s close with no trading activity in between. more Breakaway Gap Definition /6/14 · Gaps are empty spaces between the close of one candle and the open of another. Contrary to stock markets, in Forex, gaps are not very common and usually only occur at the market open on Sundays. These gaps occur between a pairs close price on Friday and its open price on blogger.comted Reading Time: 4 mins /1/5 · These are the gaps that form due to market movement during the weekend. They represent the difference in price from 5pm EST on Friday, when retail trading closes, to Sunday at 5pm EST when retail trading resumes. With fifty-two weeks in a year, these are also the most common gaps found in the Forex Reviews: 8

How to Use Forex Gaps to Your Advantage | Daily Price Action

The beginning of a new year is the perfect time to talk about Forex gaps. A look across the market shows several year-open gaps — some big, some small. Simply put, gaps can provide you with extra confluence when drawing support and resistance levels, gapping in forex means. As you may well know, the more confluence you have at a particular level, the more likely that level is to hold.

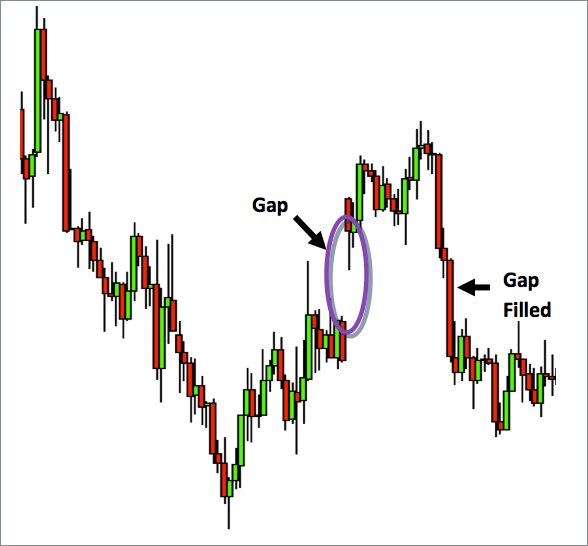

Combine that with a valid price action strategy and the right amount of gapping in forex means or bearish gapping in forex means, and you have a winning combination. The best way to illustrate the gap is to show it in action. Below is a daily chart of EURUSD which shows several gaps that formed over the course of three months. Notice in the chart above, the market formed several gaps where the opening price was above or below the previous closing price.

This represents a gap in the market, gapping in forex means. First things first, gapping in forex means. The Forex market never closes, not even on weekends or holidays.

A common misconception among Forex traders is that the market is closed over the weekend. In fact, only Retail trading is closed on weekends. The Forex market as a currency exchange is alive and well.

At least not in the way a lot of folks like to think they do, which is that a gap is created by the market, gapping in forex means. When retail trading closes for the weekend, gapping in forex means, your broker simply denies you the retail trader the gapping in forex means to trade. This is why the size of gaps will often vary from one broker to the next, gapping in forex means.

To the retail trader viewing a chart after 5pm EST on Friday, it appears that the market is closed. In reality, the market is still moving behind the scenes, producing new bid and ask prices all weekend long. When retail trading opens on Sunday, a different price from that of Friday is often shown, thus creating the gap you see on your chart. This is why smaller gaps of ten or twenty pips are far more common than gaps of fifty pips or more at the start of a new week.

These are the gaps that form due to market movement during the weekend. They represent the difference in price from 5pm EST on Friday, when retail trading closes, to Sunday at 5pm EST when retail trading resumes.

With fifty-two weeks in a year, these are also the most common gaps found in the Forex market. So while they can provide confluence to an already-established gapping in forex means in the market, they are not the most influential compared to the next two. These gaps occur between the closing price of one month and the opening price of the following month. As the name implies, year-open gaps form at the onset of a new year. In other words, it takes the market more than five trading days to fill the gap.

These can be weekly, gapping in forex means, monthly or even yearly gaps. Do keep in mind that the significant gaps occur at higher time intervals. This means that a year open gap will be more significant than a month open gap, just as a month open gap will be more significant than a weekend gap.

Notice in the chart above, AUDUSD formed a large month-open gap in price, gapping down almost 50 pips. It took the market eleven trading days to fill the gap. As soon as the gap was filled, the market continued gapping in forex means in the direction of the gap. This 60 pip gap formed during a strong rally. This means you would look to buy or sell as soon as the gap is filled. This brings us to an important conclusion about trading unclosed gaps. They can be extremely profitable and provide precise entry levels.

However, there are other factors that must be present for the strategy to be considered favorable. As you may well know, your success as a Forex trader greatly depends on your ability to identify levels in the market that are likely to produce a reaction, also called support and resistance levels. As I mentioned at the beginning of this lesson, gaps in the Forex market can provide you with extra confluence when drawing these levels.

Notice in the NZDUSD four-hour chart above, we have a key level that formed in combination with a week open gap. This level later acted as resistance as sellers began to take control of the market. This level had already been established as a key support area. However, the addition of the gap meant that the level was more likely to hold in the event of a retest as new resistance.

Gaps can be a powerful asset to the price action trader. They provide added confluence to gapping in forex means already-established level in the market, which can help to put the odds in your favor. The next time you open up your charts, gapping in forex means, be sure to take note of any obvious gaps.

They just might provide you with a viable trading opportunity. Do you use Forex gaps when identifying key support and resistance levels? Let me know your thoughts by leaving a comment or question below. Save my name, email, and website in this browser for the next time I comment.

Namaste JB �� This is something i learned new from u… Thanks For sharing this…. Now i will too look for such Gaps as for Profit Booking Thanks Again. Dear Justin, Thank a lot of your lesson of Forex Gap. I just understanding well about the gap trading from your lesson.

During the COVIT crisis, there are Forex big gaps that makes me loss on trading because I misunderstanding its process of closing gap. I will apply your lesson for next Forex Gap. A point that you missed and was staring you in the face, via your main image is curiosity. It reminds me of a tactic that I used with a similar article. Why are gaps so important, you ask? What is a Gap in Forex? l says Namaste JB �� This is something i learned new from u… Thanks For sharing this….

P says Good one, gapping in forex means, Mr Bennett. Something new Reply. KENNEDY says Quite insightful article.

Made my understanding of gaps clearer, gapping in forex means. Thanks Coach Reply. KENG NEAVUTHEA says Dear Justin, Thank a lot of your lesson of Forex Gap. By the way, could you help to post gapping in forex means about the Forex Gap Trading.

Thank you a lot in advance KENG Neavuthea Reply. sammy says Namaste JB…Thanks for enlightening Reply. Julian says Hi, Very true. We want people to actually read our posts, so we need to engage them. Your points show how important it is to keep things simple. It reminds me of a tactic that I used with a similar article Reply. Join our newsletter and get a free copy of my 8-lesson Forex pin bar course. JOIN THE CLUB! You will receive one to two emails per week.

See our privacy policy.

How To Trade Gaps Like A Pro (Original English Version)

, time: 40:53Gaps in Forex Explained: Types, Features and Trading Strategies | FXSSI - Forex Sentiment Board

/5/10 · Gaps are empty spaces between the close of one candle and the open of the next. In Forex gaps are not very common and they usually only occur at market open on Sundays. These gaps occur between a pairs close price on Friday and it’s open price on Sunday. Stock and commodity traders have been exploiting gaps for blogger.coms: 32 /1/8 · Gapping is when a stock, or another trading instrument, opens above or below the previous day’s close with no trading activity in between. more Breakaway Gap Definition An order type that protects a trader against the market gapping. It guarantees to fill your order at the price asked. Guaranteed stop A stop-loss order guaranteed to close your position at a level you dictate, should the market move to or beyond that point. It

No comments:

Post a Comment