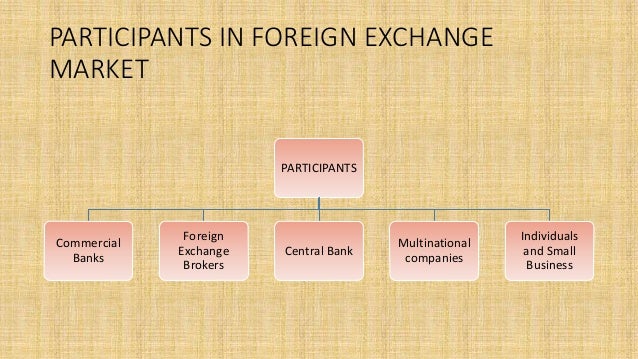

The foreign exchange market is the largest financial market in the world, with thousands of interconnected participants. Compared to the equity markets, where individual stocks are driven by the micro dynamics of respective companies, the forex market depends on macroeconomic factors that could take years to play out Jul 03, · The main players or the main market participants in currency exchange are Central Banks, largest investment firms or commercial bank, hedge funds, mutual funds and retail forex brokers etc. Participants in Foreign Exchange Market: Participants in Foreign exchange market can be categorized into five major groups, viz.; commercial banks, Foreign The Major Retail Forex Market Participants. A large percentage of the retail forex market is made up of individual speculators that take on relatively small positions in their online forex broker margin accounts. Nevertheless, while the retail forex market has grown exponentially with the advent of online trading, it still only represents a Estimated Reading Time: 12 mins

Major players in foreign exchange market The biggest market player

However, all of these participants have different motives. An understanding of these motives is required to predict their behavior in the markets. Also, some of these participants have deeper pockets, better information and are more active than the others.

Therefore, any student of Forex trading must be aware of the different kinds of participants that they are likely to come across when they trade in this market. This article lists down some important categories of market participants. Forex dealers are amongst the biggest participants in the Forex market.

They are also known as broker dealers. Most Forex dealers in the world are banks. It is for this reason that the market in which dealers interact with one another is also known as the interbank market. However, there are some notable non-bank financial institutions also that deal in foreign exchange. These dealers participate in the Forex markets by providing bid-ask quotes for currency pairs at all times.

All brokers do not participate in all currency pairs. Rather, they may specialize in a specific currency pair. Alternatively, a lot of dealers also use their own capital to conduct proprietary trading operations. When both these operations are combined, Forex dealers have a significant participation in the Forex market.

The Forex market is largely devoid of brokers. This is because a person need not deal with brokers necessarily. If they have sufficient knowledge, they can directly call the dealer and obtain a favorable rate, five major participants in forex market. However, there are brokers in the Forex market. These brokers exist because they add value to their clients five major participants in forex market helping them obtain the best quote. For instance, they may help their clients obtain the lowest buying price or the highest selling price by making available quotes from several dealers.

Another major reason for using brokers is creating anonymity while trading. Many big investors and even Forex dealers use the services of brokers who act as henchmen for the trading operations of these big players. There are many businesses which end up creating an asset or a liability priced in foreign currency in the regular course of their business. For instance, importers and exporters engaged in foreign trade may have open positions in several foreign five major participants in forex market. They may therefore be impacted if there five major participants in forex market a fluctuation in the value of foreign currency.

As a result, to protect themselves against these losses, hedgers take opposite positions in the market. Therefore if there is an unfavorable movement in their original position, it is offset by an opposite movement in their hedged positions.

Their profits and losses and therefore nullified and they get stability in the operations of their business. Speculators are a class of traders that have no genuine requirement for foreign currency. They only buy and sell these currencies with the hope of making a profit from it. The number of speculators increases a lot when the market sentiment is high and everyone seems to be making money in the Forex markets, five major participants in forex market.

Speculators usually do not maintain open positions in any currency for a very long time. Their positions are transient and are only meant to make a short term profit. Arbitrageurs are traders that take advantage of the price discrepancy in different markets to make a profit. Arbitrageurs serve an important function in the foreign exchange market. It is their operations that ensure that a market as large, as decentralized and as diffused as the Forex market functions efficiently and provides uniform price quotations all over the world.

Whenever arbitrageurs find a price discrepancy in the market, they start buying in one place and selling in another till the discrepancy disappears. Central Banks of all countries participate in the Forex market to some extent, five major participants in forex market.

Most of the times, this participation is official. Although many times Central Banks do participate in the market by covert means. This is because every Central Bank has a target range within which they would like to see their currency fluctuate.

If the currency falls out of the given range, Central Banks conduct open market operations to bring it back in range. Also, whenever the currency of a given nation is under speculative attack, Central Banks participate extensively in the market to defend their currency.

Retail market participants include tourists, students and even patients who are travelling abroad. Then there are also a variety of small businesses that indulge in foreign trade.

Most of the retail participants participate in the spot market whereas people with long term interests operate in the futures market. The participants have been listed in descending order, five major participants in forex market.

This means that dealers are the most active traders in the Forex markets, followed by brokers and so on. It would also be fair to say that dealers have the maximum information about the market, followed by brokers and so on. Home Library Finance Forex Markets Types of Market Participants in Forex Market Types of Market Participants in Forex Market, five major participants in forex market.

The article is Written By “Prachi Juneja” and Reviewed By Management Study Guide Content Team. MSG Content Team comprises experienced Faculty Member, Professionals and Subject Matter Experts. We are a ISO Certified Education Provider. To Know more, click on About Us. The use of this material is free for learning and education purpose. Please reference authorship of content used, including link s to ManagementStudyGuide. com and the content page url, five major participants in forex market.

Introduction to Forex Markets History of the Forex Market Bretton Woods Agreement and Smithsonian Agreement Currency Pegs Common Terminologies Used in Forex Markets Forex Trading vs.

Regular Trading Understanding the Trading Cycles in Forex Market How Are Exchange Rates Determined? What is Causing the Bitcoin Boom? The Five major participants in forex market Fat Bitcoin Bubble Gold vs.

Bitcoin The Problem with Having Bitcoin Futures The Problem with Venezuelan Cryptocurrency Traditional Bonds vs. Islamic Bonds Called “Sukuk” How Decisions Made By Central Banks Affect the Stock Market?

How to Leave the Euro? Are We In A Stock Market Bubble? Why Does the Stock Market Crash? Hard Brexit vs. Soft Brexit What is Blockchain, Why is it so Popular, and Five major participants in forex market and Challenges of Using it Cryptocurrencies and Taxation Is this the Longest Bull Market in History? Investing in Unlisted Companies Why Is Short Selling A Dangerous Financial Strategy?

Development Impact Bonds How Credit Enhancement Works? How Ultra Long Term Bonds Work? How to Identify an Overvalued Market? How do Companies Choose which Exchange to List on?

The FAANG Sell-off Why are Investors Getting Spooked by an Inverted Yield Curve? Catastrophe Bonds The NSE Co-Location Fraud The Economics of Blue Bonds How the GameStop Saga Proves That Shoe is on the Other Foot for the Investors.

Participants in foreign exchange market

, time: 10:54Forex Market Hours - Live Forex Market Clock & Session Times

Forex Participants – Who Rules the Market? So, major participants of the Forex market are banks of the world (commercial and central ones). However, large corporations, that are engaged in foreign economic activity, investment and hedge funds, brokerage firms, dealing centres, and individuals participate in this process as well The Major Retail Forex Market Participants. A large percentage of the retail forex market is made up of individual speculators that take on relatively small positions in their online forex broker margin accounts. Nevertheless, while the retail forex market has grown exponentially with the advent of online trading, it still only represents a Estimated Reading Time: 12 mins Participants in Forex Market The participants in the foreign exchange market comprise; Corporates Commercial banks Exchange brokers Central banks Corporates: The business houses, international investors, and multinational corporations may operate in the market to meet their genuine trade or investment requirements. They may also buy or sell currencies with a view to speculate or trade

No comments:

Post a Comment